Valuation Isn’t Just a Number

How Pricing Your Startup Shapes Perception, Expectations, and Your Next Round

On my quiet little street, a house sits unsold.

I walk by each day, watching the story unfold: buy low, tear down, build new, and flip for a profit. Yet months have passed, and the “For Sale” sign remains. What once looked like easy money now feels stuck. The owner faces a dilemma — wait longer, spend more, or lower the price.

Startups fall into the same trap. Overprice, and you don’t just risk rejection — you invite doubt. Investors wonder: What’s wrong with it? If no one’s biting, maybe something’s off. And once that doubt creeps in, it spreads. Even if you adjust, new questions emerge: If you thought you needed $4M, why are you suddenly okay with $2M? Did someone take a closer look and walk away?

Meanwhile, time is ticking. Fundraising isn’t just about getting capital — it’s a tax on execution; it’s a full-time job. The longer you spend pitching, the less time you have to build. A dragged-out round kills momentum, forces bad trade-offs, and shifts focus from growth to survival.

The best founders don’t just ask, How much can I raise? They ask, Am I setting a valuation that keeps my options open? Because valuations aren’t just numbers — they set expectations. They shape how investors perceive your startup before they even meet you. And the wrong expectations can close doors before the conversation even starts.

So, How are Valuations Actually Set?

A founder sees a headline: Startup X raises $20M at a $100M valuation. They look at their own company — same stage, same space - and think, why not us?

Fair question. Wrong mindset.

Early stage valuation isn’t a science. It’s not even math. It’s a mix of storytelling, market psychology and negotiation.

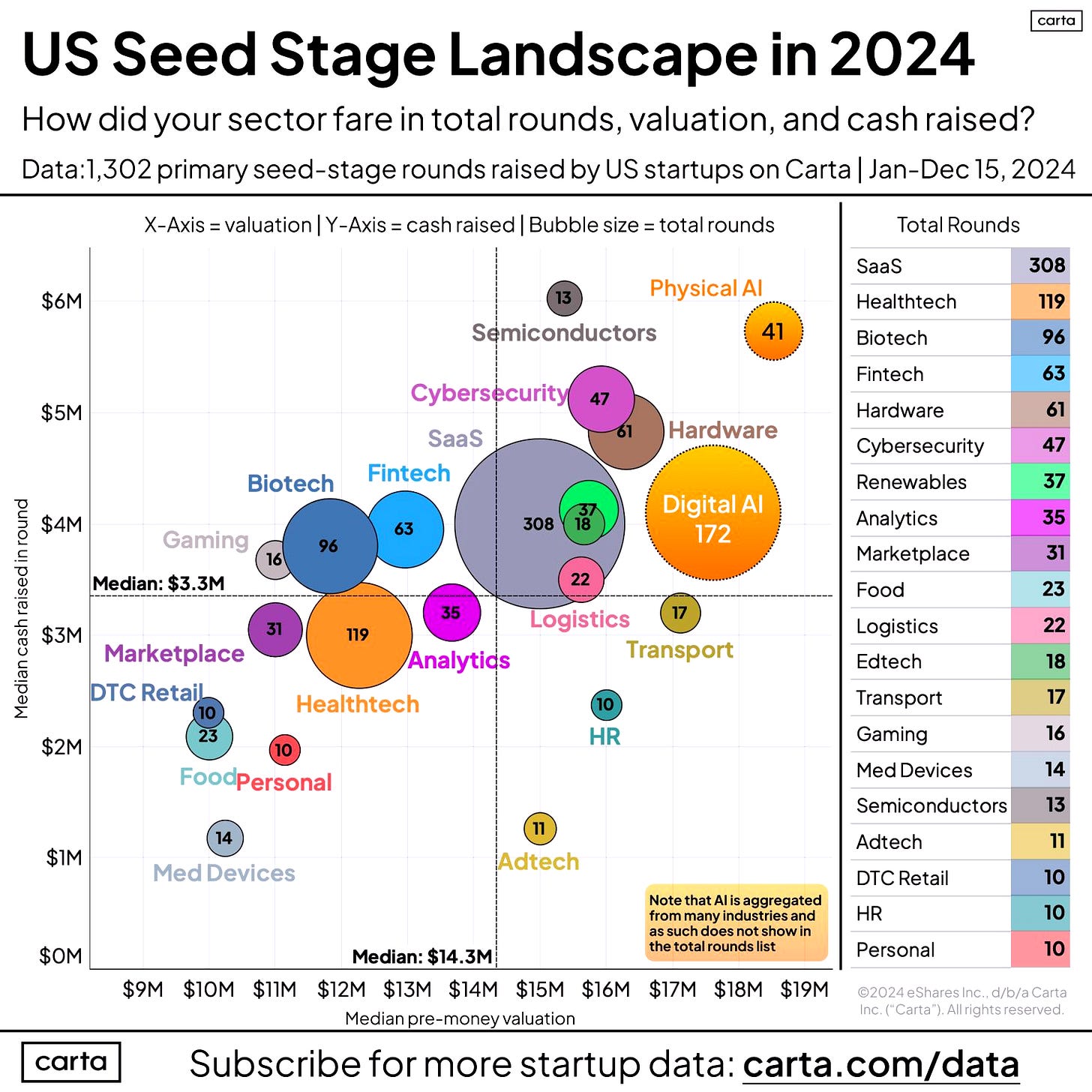

While later-stage startups get priced on revenue, margins, and growth — Pre-seed and seed rounds are priced based on perception. Investors don’t start with a formula. They look around — what are similar companies raising at? How hot is this sector? How much leverage does the founder actually have?

Think of startup valuations like real estate pricing. If AI startups are closing rounds at $15M, that becomes the “neighbourhood comp” — even if some are ChatGPT-powered apps with a pitch deck.

Investors use platforms like PitchBook and Carta like homebuyers check HouseSigma.1 But just as a house isn’t valued on square footage alone, a startup’s price tag typically considers:

Stage of Development: Are you pre-product, pre-revenue, or showing traction?

Team Strength: A repeat founder with a track record commands a premium. A first-timer has more to prove.

Market & Narrative: Are you riding a wave (e.g. AI) in a big market or fighting the current?

Traction & Metrics: Even a strong waitlist can shift perception.

Business Model & IP: Software companies command higher multiples due to scalability, while hardware startups must prove capital efficiency. Proprietary IP, particularly in deep tech or biotech, can justify higher valuations — but only if the market opportunity is strong.

These factors also don’t carry equal weight. Investors don’t price startups on a smooth curve but bucket risk into categories. A company with nothing but an idea is one kind of bet. A company with a working product is another. A company with revenue? That’s a different conversation entirely. That’s why when you raise matters as much as how much. Stretch your capital just long enough to clear a key milestone - moving from idea to product, pre-revenue to first customer — and you don’t just improve your odds. You change the entire equation.

Market Cycles

To make it more complicated, that equation also shifts with market conditions.

In a bull market, capital flows freely, and FOMO drives valuations higher. Investors compete, not just evaluate. The best fundraisers spark bidding wars — like a hot real estate market where buyers rush in, not for what the house is today, but for what it could become.

In a down market, the reverse happens. Capital tightens, scrutiny increases, and suddenly, that same house sits unsold — forcing price cuts just to attract interest. Founders who raised at sky-high valuations in boom times often struggle to justify them later. The market, not the founder, ultimately sets the price.

In today's challenging market, expectations for Series A have continued to rise. Where it was once acceptable to raise with $500K-$1M ARR, many investors now expect more than $2M ARR. Seed-stage founders must align their milestones to these shifting benchmarks. If you don’t show a clear path to those targets, today’s valuation could become a hurdle instead of an advantage.

The Psychology of Inflated Valuations

Much like being house poor — stretching to afford a home that signals success while quietly making life harder — things get messy when valuation stops being just about securing capital and starts becoming personal: a status symbol, a reflection of self-worth, a way to prove you belong in the right league. The higher the number, the greater the validation.

No founder wakes up and thinks, “Let’s set a ridiculous valuation just for fun”. More often than not, it’s fear:

Fear of leaving money on the table. “If I don’t push for a higher valuation, am I underselling myself?” Many founders fixate on dilution benchmarks, but the real goal is momentum. The right valuation keeps investor appetite strong — not just an extra percentage point of ownership.

At the same time, underpricing has its own risks. A valuation set too low may signal weak confidence, limited ambition, or a business that won’t scale. Worse, it can lead to excessive dilution early on, making future rounds harder. The sweet spot isn’t the highest or lowest number — it’s the one that keeps all options open.Fear of looking weak. “If others are raising at $20M, what does it say about me if I only raise at $12M?” But valuation is only as strong as the traction behind it. Overpricing without real leverage leads to a longer, tougher fundraise.

Fear of losing control. “If I don’t anchor high, will investors take too much of my company?” Ironically, overpricing often leads to less control. When growth doesn’t match expectations, investors push for tougher terms — higher liquidity preferences, steeper discounts, or board control.

And investors? Some play along. A high valuation isn’t about the startup’s long-term success — it’s about looking good on paper. If a VC can show their LPs (limited partners) that their portfolio is appreciating, they look like winners — whether or not the underlying companies are actually thriving.

So founders push high valuations out of fear. Some investors encourage it out of self-interest. It’s a dance — intoxicating in the moment but often messy in the long run.

When High Pricing Becomes A Trap

A high valuation isn’t just a number. It’s a promise. Lock in an aggressive price, and expectations shift. Investors expect a rocket ship. Employees expect hyper growth. And suddenly, your unspoken job becomes justifying the number.

That pressure leads to bad decisions:

Spending to Justify the Valuation. If you raised at a premium, shouldn’t you be operating like a high-growth company? Founders often feel compelled to hire aggressively, expand too soon, or chase unsustainable revenue just to match investor expectations. Burning cash just to justify a number isn’t growth - it’s a trap.

The Fundraising Squeeze. A high valuation today sets a high bar for tomorrow. Investors won’t just ask “Are you growing?” — they’ll ask “Are you growing fast enough to justify the last round’s price?” If not, raising again becomes a challenge.

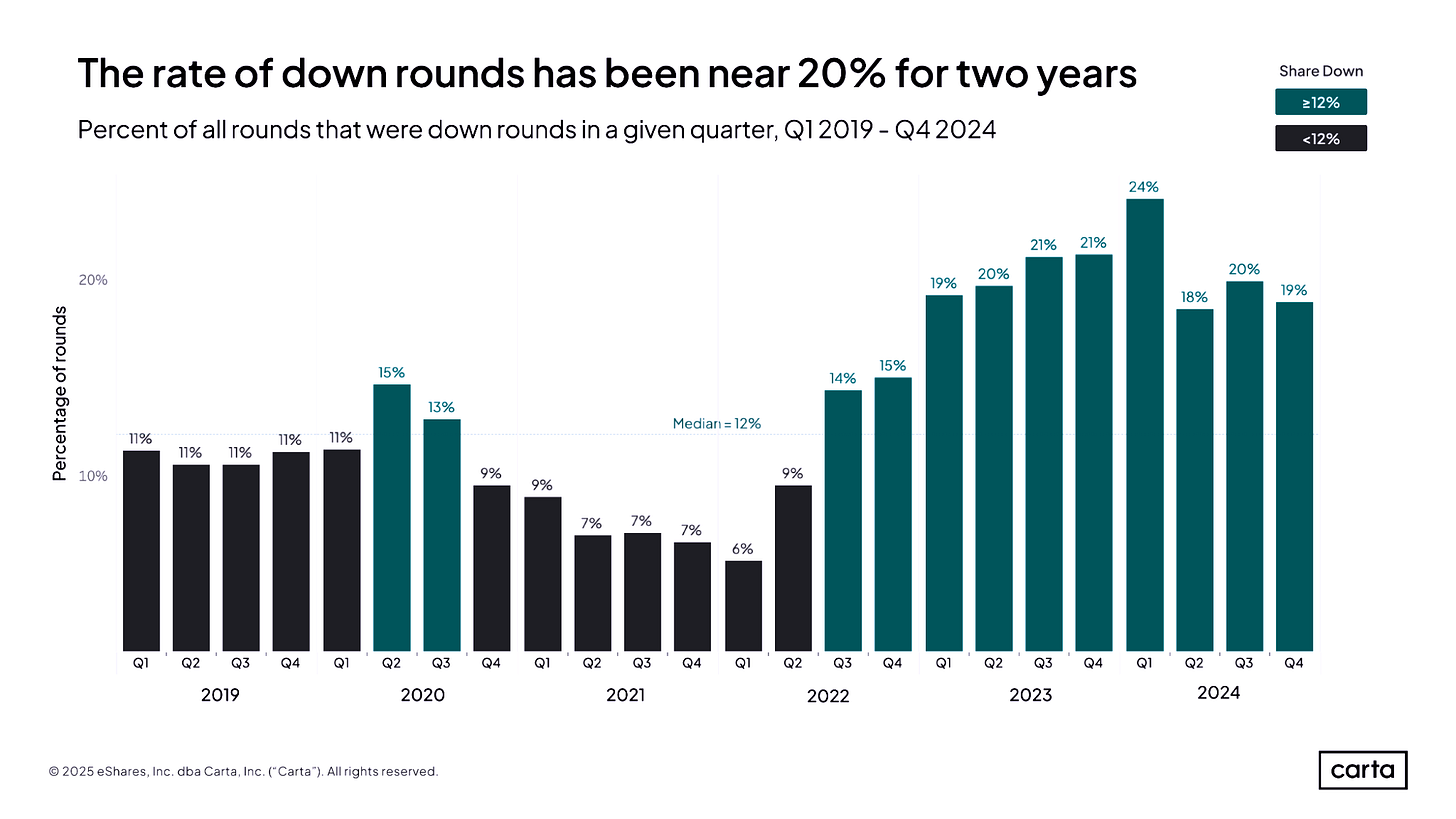

The structure of that raise matters too. Rising on a high valuation cap (via a SAFE or convertible note) may push the problem down the road, but doesn’t erase it. A priced round, on the other hand, forces the issue upfront. Either way, the risk remains — as Carta data shows, nearly 60% of startups faced bridge or down rounds in 2024 — proving that aggressive pricing eventually catches up.2

Less Control, Not More. The irony? Many founders push for a higher valuation to maintain ownership — only to find themselves with less control later. If growth lags, investors gain leverage to impose tougher terms — higher liquidation preferences, steeper discounts, or, in extreme cases, replacing leadership.

At the same time, an inflated valuation makes it harder to attract both talent and buyers, as employees lose confidence in overpriced stock options and acquirers hesitate over unrealistic expectations.

At that point, you’re stuck. Your choices? A down round, a bridge round, or a burnout spiral.3

How Much Should I Raise?

Early-stage founders often set fundraising targets based on what others are raising. That’s a mistake.

The best founders work backward from their next inflection point — just like smart homebuyers use mortgage calculators and budgets to plan their purchase.

Step 1: Define and Validate the Next Milestone

What will make your company significantly more investable in 18-24 months? Product launch? A validated pricing model? Demonstrated go-to-market traction? What metrics will later-stage investors expect before writing a check?Step 2: Map Out Costs

What does it actually take to get there — including a buffer for pivots, delays, or unexpected challenges? Optimistic budgeting is a common founder trap. Plan for the real road ahead, not just the ideal one.Step 3: Leave Room for the Next Round

Structure your round so that you have multiple paths forward. Raising at a valuation you can confidently grow into makes future fundraising easier — giving you the option to raise again on strong terms or even extend runway without external capital.

Instead of asking, How much can I raise?

Ask: What number gets me to the strongest position for my next round?

The Real Question: Can You Keep Playing?

Great founders think like great house flippers. They price based on fundamentals, not hype. They know their next buyer (investor) before setting the price. And they focus on liquidity, not just valuation, so there’s always a market for their company.

Before listing a house, a smart flipper asks: If I can’t sell in 12 months, is this still a good investment? Before raising a round, a smart founder asks: If I can’t raise again at a higher valuation, will this funding still set me up for success?

Because in the startup game, valuation isn’t about the highest number — it’s about staying in the game long enough to win.

Zillow for our US friends

https://carta.com/data/state-of-private-markets-q4-2024/

Cutting costs to extend runway, at the expense of momentum.